Reports

Hyderabad Coworking & Managed Offices Report - Feb 2026

Shyam Sundar Nagarajan / Reading Time : 7 mins

Table of Contents

- Core Market Analysis: Key Submarket Deep Dives

- HITEC City: The Technological Core

- Gachibowli: The Managed Office Extension

- Kondapur: The Premium and Mid-Range Hybrid

- Madhapur and Financial District: Niche Tech Corridors

- Comprehensive Pricing and Operator Landscape

- Premium Office Spaces (₹15,000+ per month)

- Mid-Market and Corporate Flex Tier (₹7,000 - ₹14,999 per month)

- Budget-Friendly and Emerging Hubs (Under ₹7,000 per month)

- Inventory Analysis: Capacity and Cabin Configurations

- Capacity vs. Price Ratio Analysis

- Conclusion

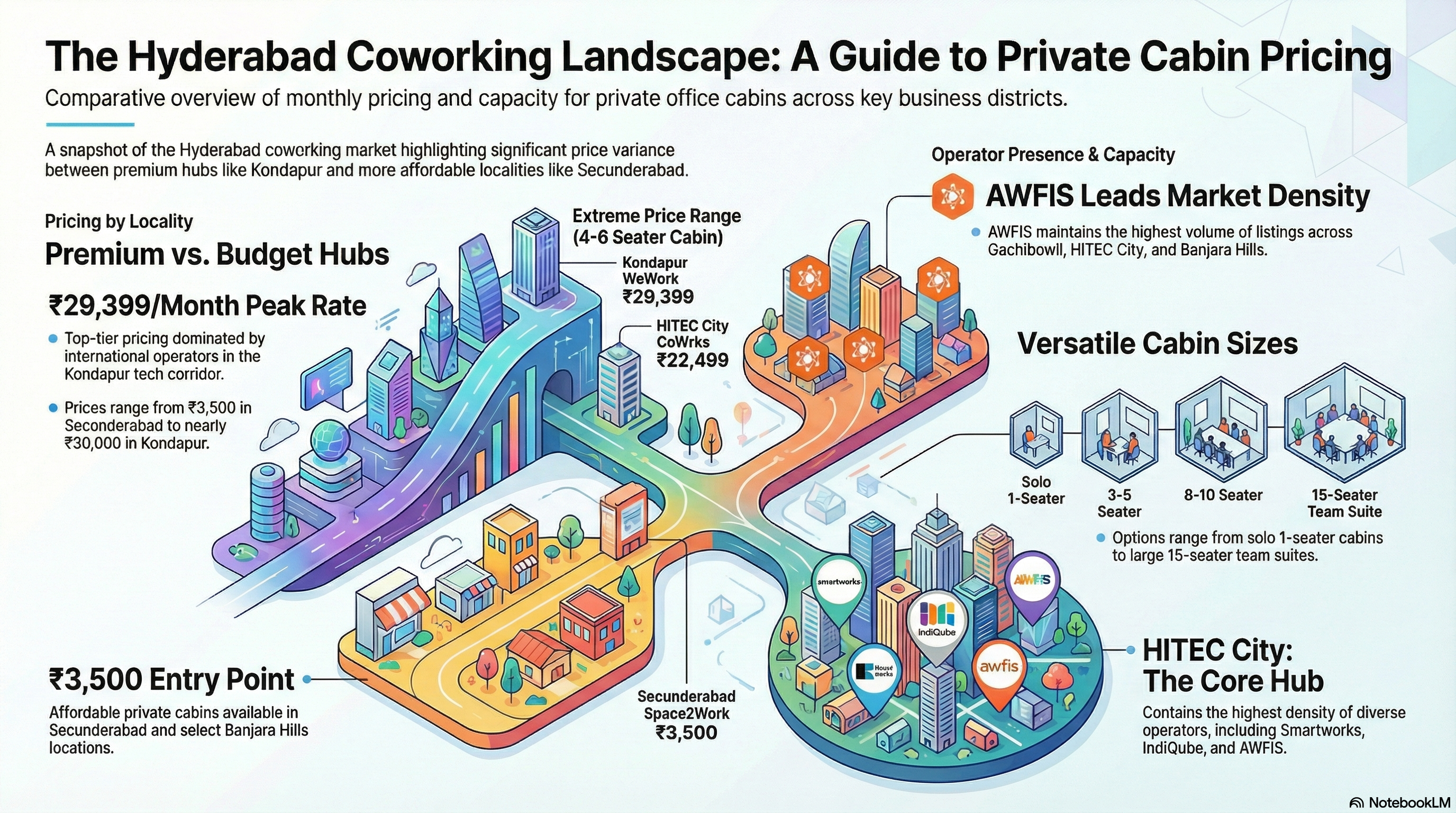

As of February 2026, the commercial real estate (CRE) landscape in Hyderabad has reached a stage of peak maturity, significantly departing from the traditional long-term leasing models that dominated the pre-2024 era. The acceleration of the "flight to quality" and the institutionalization of hybrid work models have catalyzed a massive shift toward Managed Offices (MO) and Enterprise Coworking solutions. For modern organizations, the core value proposition has shifted from simple "desk rental" to a sophisticated "Office-as-a-Service" (OaaS) framework.

In this current market cycle, Hyderabad has solidified its standing as a primary global technology hub, with flexible workspace absorption rates rivaling established tier-1 metros. The demand is no longer driven solely by the venture-backed startup ecosystem; instead, mid-to-large-cap multinational corporations (MNCs) are the primary drivers of Grade-A occupancy.

These entities prioritize operational expenditure (OPEX) over capital expenditure (CAPEX), seeking to mitigate the risks associated with volatile headcount projections and long-term lock-ins. This report analyzes the 2026 market through the lens of operator pricing, geographical clustering, and inventory density, providing a data-driven roadmap for corporate real estate directors and stakeholders.

Key chapter:

Core Market Analysis: Key Submarket Deep Dives

The Hyderabad flexible workspace market is bifurcated into highly specialized micro-markets. Each submarket offers a distinct risk-reward profile based on its proximity to the IT corridors and transit infrastructure, notably influenced by the completion of the Hyderabad Metro Phase II.

Also read: Hyderabad Meeting Spaces Report

HITEC City: The Technological Core

HITEC City remains the undisputed epicenter of Hyderabad’s managed office activity, boasting the highest concentration of institutional operators such as Smartworks, CoWrks, and AWFIS. The submarket exhibits significant yield variance, driven by the disparity between Grade-A+ and Grade-B assets.

For instance, CoWrks Skyview—situated in a premium IT corridor—commands a top-tier price of ₹22,499 per seat. This pricing reflects the asset's superior amenity package, proximity to the Metro, and the operator's focus on high-end hospitality integration. Conversely, Smartworks Purva Summit offers a more optimized entry point at ₹7,499 per seat.

This gap is indicative of the "Value vs. Premium" split in HITEC City; while CoWrks targets the executive suite and luxury enterprise niche, Smartworks focuses on high-density enterprise scaling, as seen in their Raheja Mindspace facility which maintains a steady ₹11,000 across 4 to 10-seater configurations. This density allows for better EBITDA margins for operators through scale, even at a lower price point than boutique competitors.

Gachibowli: The Managed Office Extension

Gachibowli has evolved into the primary destination for managed office extensions, particularly for firms looking to avoid the supply-constrained core of HITEC City. The submarket is dominated by sprawling corporate parks and modern builds like the MPM Corporate House and RAMKY TOWERS.

WellWork is a pivotal player in the Gachibowli-Jayabheri Pine Valley corridor. Their pricing strategy utilizes "anchor pricing" for smaller units, with a 1-seater private cabin listed at ₹15,000, whereas their 5-seater to 12-seater suites are priced more competitively at ₹12,000. This tiered approach incentivizes larger team occupancy.

Simultaneously, IndiQube Pearl in the RAMKY TOWERS provides a standardized corporate solution at ₹7,500 per month, a price point that has become the benchmark for mid-tier managed offices in the district. The submarket's resilience is further bolstered by operators like AWFIS Sreshta Marvel (₹12,999), which bridge the gap between suburban convenience and corporate prestige.

Kondapur: The Premium and Mid-Range Hybrid

Kondapur’s growth trajectory in 2026 is a byproduct of its strategic location between the residential hubs and the Financial District. It hosts the most expensive real estate in the city's flex-market. WeWork Krishe Emerald represents the market peak at ₹29,399 per month. This premium is justified by the operator's global ecosystem and the facility’s integration of high-end ESG (Environmental, Social, and Governance) standards, which are increasingly mandatory for European and North American MNCs.

However, Kondapur also offers a robust mid-range segment to prevent market overheating. CoKarma on Botanical Garden Road (₹7,000) and EFC Sprint in Jayabheri Silicon Towers (₹7,500) serve as essential pressure valves, offering Grade-A locations at a 75% discount compared to the WeWork peak. This polarization makes Kondapur a highly versatile micro-market for tiered departmental placement.

Madhapur and Financial District: Niche Tech Corridors

The Financial District (Nanakramguda) and Madhapur act as the "High-Density Corridors." In the Financial District, WeWork Rajapushpa Summit (₹20,899) and AWFIS Prestige Skytech (₹12,999) serve the banking and financial services (BFSI) sectors. Madhapur, while more congested, offers specialized tech hubs like Offix (₹19,000) and Uniton IHub (ranging from ₹6,400 to ₹8,500), catering to specialized project teams that require proximity to the Madhapur metro and established tech parks.

Comprehensive Pricing and Operator Landscape

Premium Office Spaces (₹15,000+ per month)

The premium tier is characterized by global standards, advanced security protocols, and concierge-level services. Organizations in this tier are typically willing to pay a premium for brand alignment and "plug-and-play" simplicity.

Space Name | Locality | Monthly Price (INR) |

WeWork Krishe Emerald | Kondapur | ₹29,399 |

CoWrks Skyview | HITEC City | ₹22,499 |

WeWork Rajapushpa Summit | Financial District | ₹20,899 |

Offix | Madhapur | ₹19,000 |

Smartworks Aurobindo Galaxy | Serilingampalle (M) | ₹16,000 |

WellWork (1 Seater) | Gachibowli | ₹15,000 |

Need help with choosing the right space?

Ajay

Sales expert

Ajay and his team have helped 100s of clients with the right spaces.

Mid-Market and Corporate Flex Tier (₹7,000 - ₹14,999 per month)

This segment represents the "Engine Room" of the Hyderabad office market. The heavy presence of AWFIS—across sites like Aurobindo Orbit, Lorven Tiara, and Prestige Skytech—indicates their strategy of market saturation across all major IT corridors.

Space Name | Locality | Monthly Price (INR) |

AWFIS Sarvotham | HITEC City | ₹13,000 |

91Springboard Raheja Commerzone | HITEC City | ₹13,000 |

AWFIS Lorven Tiara | Kondapur | ₹12,999 |

AWFIS Aurobindo Orbit | Serilingampally | ₹12,999 |

AWFIS Prestige Skytech | Nanakramguda | ₹12,999 |

Smartworks Raheja Mindspace | HITEC City | ₹11,000 |

AWFIS NSL ICON | Banjara Hills | ₹9,999 |

AWFIS Taj Deccan | Banjara Hills | ₹7,799 |

IndiQube Pearl | Gachibowli | ₹7,500 |

Smartworks Purva Summit | HITEC City | ₹7,499 |

Need help with choosing the right space?

Ajay

Sales expert

Ajay and his team have helped 100s of clients with the right spaces.

Budget-Friendly and Emerging Hubs (Under ₹7,000 per month)

Ideal for small units and the burgeoning "neighborhood office" trend where employees work closer to home to reduce the commute-to-work ratio.

Space Name | Locality | Monthly Price (INR) |

Hatch Station | Begumpet | ₹6,500 |

Uniton IHub Coworking | Madhapur | ₹6,400 |

VUnite | Banjara Hills | ₹3,500 - ₹5,900 |

MBDesk.com | Karkhana | ₹4,000 |

KeyOnPlus | Gachibowli | ₹4,250 - ₹5,000 |

Space2Work Co-Working Hub | Secunderabad | ₹3,500 |

Inventory Analysis: Capacity and Cabin Configurations

The physical inventory in Hyderabad is overwhelmingly focused on private cabins, with a specific emphasis on the "scalability ladder" (moving from 4 to 10-seater configurations). Analysts observe that the market has largely abandoned the open-coworking model in favor of the acoustic and visual privacy required by enterprise-grade occupants.

Capacity vs. Price Ratio Analysis

A key metric for the 2026 market is the efficiency of spend per desk. While premium operators offer higher aesthetic value, the per-desk economics vary wildly based on cabin density.

Operator & Space | Cabin Size | Total Monthly Price | Calculated Per-Desk Price |

WeWork Krishe Emerald | 4-Seater | ₹29,399 | ₹7,349.75 |

CoWrks Skyview | 10-Seater | ₹22,499 | ₹2,249.90 |

Smartworks Purva Summit | 10-Seater | ₹7,499 | ₹749.90 |

IndiQube Pearl | 10-Seater | ₹7,500 | ₹750.00 |

AWFIS Lorven Tiara | 10-Seater | ₹12,999 | ₹1,299.90 |

VUnite (Banjara Hills) | 10-Seater | ₹3,500 | ₹350.00 |

This data reveals a significant finding: larger cabins at mid-market and budget operators offer exponential cost-savings for the tenant, whereas premium operators like WeWork maintain a high per-desk yield regardless of cabin scale.

Need help with choosing the right space?

Ajay

Sales expert

Ajay and his team have helped 100s of clients with the right spaces.

Conclusion

As we look toward the remainder of 2026, the Hyderabad flexible workspace market is projected to maintain a Compound Annual Growth Rate (CAGR) of 14-16% in terms of total desk inventory. The convergence of diverse price points—from the extreme affordability of ₹3,500 in Secunderabad to the ultra-premium ₹29,399 in Kondapur—demonstrates a market that is healthy, competitive, and highly segmented.

The dominance of "Office-as-a-Service" means that the decision to lease is no longer just about the real estate; it is about the agility it provides. The market has moved beyond simple coworking into a phase of professionalized managed suites that solve for tech-integration, security, and employee experience.

GoFloaters remains the premier partner for organizations navigating this nuanced landscape. By utilizing the granular data analyzed in this report—including specific per-desk ratios, operator yield variances, and geographical strategic profiles—GoFloaters enables businesses to execute their office strategies with precision.

Whether you are an MNC requiring a 10-seater hub in HITEC City or a growing startup seeking a budget-optimized 4-seater in Karkhana, the data proves that Hyderabad's ecosystem is more than capable of supporting your operational scale.